Last Updated on 2025-11-13 by Pickleball Expert

Pickleball has moved off the “niche” shelf and into mainstream sport and recreation in record time. What started as a backyard pastime has become a billion-dollar ecosystem that includes equipment manufacturers, clubs and facilities, organized tours, broadcast deals, consumer retail, and community programs. This report analyzes the state of the Pickleball market in 2025, synthesizing participation data, market-size estimates, infrastructure growth, professionalization trends, and the practical implications for suppliers and operators.

Key takeaways up front:

Pickleball participation exploded across the U.S. in the early 2020s and continued strong growth into 2024–2025, creating broad demand for equipment, courts, lessons and events.

Multiple market reports estimate the global pickleball market (equipment + services) is growing rapidly, with multi-billion-dollar projections by the early 2030s — though different research groups use different scopes and methodologies.

Court infrastructure is expanding quickly: tens of thousands of dedicated courts have been added in recent years, fueling local demand for nets, court surfacing, lighting and facility services.

Professionalization and media deals (league growth, sponsorships, localized broadcast distribution) are legitimizing the sport and creating new B2B revenue channels for equipment partners and venue operators.

Below is the full, structured analysis you can use as a blog post or downloadable market brief.

1-Macro snapshot: Where the Pickleball Market stands in 2025

Participation: scale and demographics

Pickleball’s participant base saw dramatic growth between 2020–2024, and the momentum carried into 2025. Estimates vary slightly by source and methodology, but credible participation reports and industry trackers place U.S. active players in the high millions (with SFIA/industry reports indicating around ~19.8M players in 2024) and continuing upward into 2025. This surge has made pickleball the fastest-growing major sport in the U.S. over a multi-year span.

Demographically, growth was broad-based:

Strong participation among active adults (30–64) and seniors (55+), driving demand for softer, control-oriented equipment and facility programs for older players.

Noticeable uptake among younger players (teens/20s) in urban markets and school programs, helping extend lifetime value.

Increased family play and multi-generational programming in parks and rec centers.

Market size and growth estimates

Market research firms and niche industry analysts use different definitions (equipment-only vs whole ecosystem including facilities, events, apparel, coaching). Representative estimates in late-2024 / early-2025 showed:

Equipment-focused reports estimating hundreds of millions in annual equipment sales, with the equipment market projected to grow steadily across the decade.

Broader market analyses (equipment + services + events + facility development) showing multi-billion-dollar potential over the next decade, with CAGR estimates ranging from mid-single digits to double digits depending on scope and region.

Implication: the market is large enough and diversified enough to support specialized niche suppliers as well as mass-market brands — but beware of inconsistent forecasts and be explicit about which segment (equipment, facilities, events) you target.

2-Infrastructure boom: courts, clubs and facilities

Court proliferation

One of the most visible metrics of pickleball growth has been the rapid expansion of courts. Municipalities, private clubs, commercial operators and real-estate developers converted and added tens of thousands of courts in a short period. Industry trackers reported over 60–68k tracked courts in the U.S. by early-2025, with large numbers added in 2023–2024 alone.

Court growth has followed several paths:

Tennis-to-pickleball conversions: low-cost way to create multiple courts on existing tennis footprints.

Dedicated indoor facilities: large commercial investments (multi-court indoor facilities, 24/7 clubs with food/fitness) to serve year-round play and league programming. Examples of major projects and investments were reported in 2024–2025.

Public park and rec investments: municipalities adding courts to support active-aging programs and community recreation.

Club & commercial facility economics

Large-scale indoor facilities and multi-amenity clubs emerge as economically attractive when they combine court fees, lessons, retail, food & beverage, and programming. Operators can amortize capital over memberships and events, but success requires strong community management and scheduling optimization.

Implication for suppliers: Demand for nets, court accessories, LED lighting, and replacement parts will grow. Suppliers who build B2B sales channels (bulk pricing, installation support, warranty & maintenance services) will capture higher-margin, sticky business from clubs and municipalities.

3-Equipment market: paddles , balls, nets, apparel and accessories

Product segmentation and trends

Key product categories:

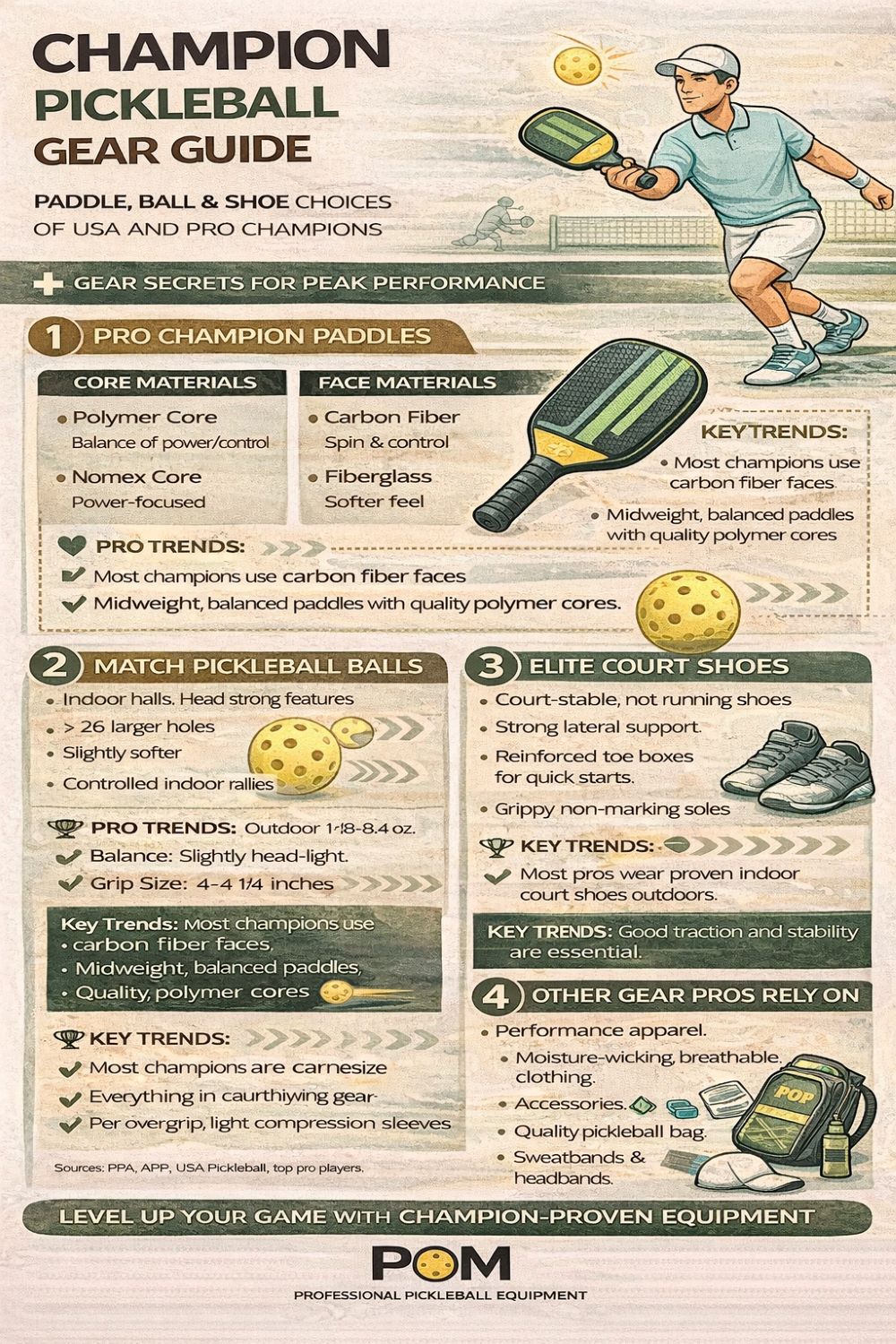

Paddles: the largest and highest-visibility segment. Innovation continues (composite materials, core materials, shapes, edge guards) as players trade up for better performance.

Balls: indoor vs outdoor differentiation; durability and consistent flight characteristics are critical for satisfaction.

Nets & portable systems: demand from recreational players and clubs for quick-setup portable nets and durable fixed systems.

Court accessories & apparel: shoes, apparel, bags, protective gear and tech add-ons (sensors) constitute important upsell categories.

Market research reported the equipment market value in the hundreds of millions in 2024 and projected steady growth. Some reports estimate equipment market growth continuing at low-to-mid single digits CAGR, while aggregate market reports that include services project much higher growth rates.

Consumer behavior & channels

Direct-to-consumer (DTC) e-commerce is a major channel — paddle brands often invest heavily in their own online stores and digital marketing. Online sales accounted for a substantial portion of equipment distribution in recent years.

Specialty retailers & club pro shops remain important for demo programs and local trust.

Mass retail / sporting goods drives volume for entry-level equipment and impulse purchases.

Implication: Investing in omnichannel strategies (DTC + retail + club partnerships), robust online content (video demos, specs, comparison tools), and trial programs (demo days) remains essential for market penetration.

4-Professionalization, media, and sponsorships — legitimizing the sport

Leagues, media deals and the spectator market

Pickleball’s maturation is visible in the rise of organized professional events and the commercialization of those events. Leagues and tours (Major League Pickleball, PPA Tour, and domestic event series) have pursued media partnerships, local distribution deals and sponsorship relationships to grow the spectator footprint. Recent announcements (2024–2025) showed local media distribution expansion and growing sponsor lists as leagues sought to broaden reach.

Sponsorship & experiential revenue

Title and equipment sponsorships (paddles, balls) are increasingly valuable as events gain broadcast and streaming audiences.

Live events and festival experiences (large venue draws, ancillary programming) show potential for matchday revenue beyond tickets (merch, F&B, activations). Recent industry coverage highlighted large facility projects and event investments aimed at building scaled matchday experiences.

Implication for suppliers: Event sponsorship (branded paddles, official ball supplier), experiential retail kiosks at major events, and co-branded limited editions are effective strategies to increase brand visibility and perceived quality.

5-Demographic & usage insights — who’s buying and why

Age & play style differences

Older adults (50+): seek control-oriented paddles, comfortable shoes, softer balls and local daytime programming. They value durability, comfort grips, and injury-preventive accessories.

Younger and competitive players: seek performance paddles, lighter weight, higher stiffness cores, and opportunities for coaching and tournaments.

Families & casual players: purchase entry-level paddles and portable nets to play backyard or multi-use courts.

Frequency & retention

Higher frequency players (weekly or more) are the primary drivers of equipment upgrades and service purchases (lessons, memberships). Retention strategies (clubs, leagues, social events) keep players spending and provide predictable B2B revenue for facility suppliers.

Implication: Tailor product lines to these segments: comfortable, forgiving paddles and shoes for seniors; high-performance models and demo fleets for competitive players; inexpensive starter kits for family/casual buyers.

6-Retail & distribution: digital-first, but omnichannel wins

E-commerce dominance + the power of demos

Online shopping continues to be very important for paddle and accessory discovery and purchase; however, conversion and post-purchase satisfaction are higher when players can demo paddles or buy through trusted local pro shops. Brands that combine strong ecommerce with demo events and club partnerships tend to outperform purely online players.

B2B sales opportunities

Supplying courts, club pro-shops, facility fit-outs and municipality contracts offers more predictable, larger SKUs than individual retail. Suppliers should invest in sales teams that understand RFP processes, installation logistics and public-sector procurement.

Implication: Build hybrid sales models — strong brand website + performance content + wholesale/B2B account team + demo and pro-shop partnerships.

7-pickleball Innovation & adjacent opportunities

Materials and product innovation

New core materials, surface coatings and composite technologies continue to differentiate paddles.

Longevity and quality of balls are a focus — products that reduce variability and last longer win club/league business.

Tech & data

Smart paddles, swing sensors, and court sensors for shot tracking are nascent but growing categories. Data-driven coaching and performance apps offer subscription revenue potential.

Venue tech (booking systems, league management, court usage analytics) is a B2B SaaS opportunity that complements equipment sales.

Implication: Suppliers who partner with tech firms (sensors, booking platforms) can extend value propositions beyond physical products into recurring services and software revenue.

8-Risks, constraints and market headwinds

No market grows without friction. Key challenges for stakeholders in 2025 include:

Supply chain & input-cost volatility

Raw material costs (composites, cores, rubbers) and global supply-chain disruptions can raise production costs. Suppliers should consider diversified manufacturing and nearshoring options.

Court availability & community pushback

Rapid court growth has sometimes ignited local conflicts (tennis-to-pickleball conversions), noise complaints, and zoning issues. Community relations and stakeholder engagement are critical for long-term facility acceptance.

Health & safety concerns

As participation skews older, injury prevention, education and appropriate product design (shoes, grips, paddles that reduce shock) will be scrutinized by clubs and insurance providers.

Market saturation & churn

In hotspots with rapid infrastructure expansion, short-term equipment demand spikes may be followed by normalization. Brands must plan for sustained engagement rather than one-time buying frenzies.

Implication: Diversify offerings (B2B + B2C + services), invest in community relations, and prioritize product durability and safety.

9-Regional & international expansion

While the U.S. remains the epicenter for pickleball growth, the sport is expanding internationally:

Canada, Western Europe, Australia and parts of Asia are growing pick-up and club activity.

International expansion requires supply-chain planning, local marketing nuance, and sometimes retooling of product lines (ball types, paddle regulations).

Implication: Suppliers with multi-market ambitions should pilot exports in culturally similar, high-income markets first and leverage distributor partnerships for localized marketing and logistics.

10-Strategic recommendations for pickleball suppliers (short & long term)

Below are concrete actions suppliers and brands can take to capitalize on the 2025 market landscape.

Immediate (0–12 months)

Strengthen club & facility B2B sales: Offer bundle deals, demo fleets, installation services, and maintenance contracts. Facilities are repeat buyers.

Run localized demo days & retailer partnerships: Combine online ads with on-court demos — conversion is higher when players can try a paddle.

Product tiering: Offer entry-level, mid-tier, and premium performance paddles & accessories. Match price to player segment and buying intent.

Event sponsorships: Sponsor regional events and amateur leagues (cost-effective visibility vs national media deals).

Inventory resilience: Pre-buy critical components or arrange safety-stock agreements to buffer supply shocks.

Mid-term (12–36 months)

Develop service products: Court maintenance kits, coaching content subscriptions, or club loyalty programs that drive recurring revenue.

Partner with tech: Integrate sensors or performance apps with paddles or court hardware to offer value-added bundles.

Expand B2B offerings: White-label nets, court surfacing partnerships, and maintenance contracts for parks & rec departments.

Build community programs: Support youth academies, senior clinics, and outreach that grow participation and long-term customers.

Long-term (3+ years)

Invest in global distribution channels: Local distributors, regional manufacturing, and market-tailored SKUs.

Vertical integration where feasible: Owning or operating facilities in target markets — a capital intensive but high-margin extension of the brand.

Sponsorship of pro circuits: As media deals mature, become official ball/paddle supplier to tournaments to anchor premium brand positioning.

11-Forecast and scenarios (qualitative)

Because forecasts differ by scope, here are three plausible scenarios for the next 3–5 years based on the 2025 landscape:

Base case (likely)

Continued steady growth in participation (moderating from the explosive early-2020s rates), driven by club openings, municipal courts and grassroots programs. Equipment market grows, though at a slower pace than initial spikes.

Upside case

Major broadcast or streaming deals scale viewership substantially, fueling sponsorship revenue and premium product sales. Large retail and club franchises expand rapidly, and technology adoption (sensors, performance apps) creates new revenue streams.

Downside case

Local opposition to courts, supply-chain shocks, or a sustained slowdown in participation growth cause a temporary contraction in equipment sales and facility investment. The market consolidates to larger, more efficient operators.

12-Appendix: Key sources and data references

(Selected sources used for the figures and narrative above — these capture the most important load-bearing facts in the analysis.)

Market.us — “Pickleball Market Size, Share, Trends” (market forecast and CAGR references).

USA Pickleball — Annual growth / membership and organizational data (2024–2025 reporting).

Global Market Insights / GMInsights — Pickleball equipment market estimates and analysis.

Pickleball.com & industry roundups — synthesis articles and market commentary (market sizing and sector overview).

Major League Pickleball news & sponsorship pages — examples of media partnerships and sponsor growth in 2025.

What suppliers should do next (practical checklist)

If you run a pickleball equipment business or are considering entering the market, here’s a short operational checklist based on the 2025 market reality:

Audit your current channel mix — increase B2B focus if you don’t already sell to clubs and municipalities.

Launch or scale a demo program — convert trial players into buyers.

Build club lifecycle offers — starter kits, seasonal replacement, and court-install bundles.

Invest in content marketing (how-to videos, demo comparisons) to reduce purchase friction online.

Explore partnerships with event organizers and pro tours for visibility and credibility.

Protect margins with supply diversification and advance procurement of critical components.

Pilot tech partnerships (sensors or software) to create recurring revenue.

pickleball market predict

The Pickleball market in 2025 presents a rare combination of high consumer enthusiasm, fast infrastructure expansion, and emerging professionalization. For nimble suppliers who execute a balanced strategy — combining DTC, retail, club partnerships, and product innovation — the next several years offer substantial opportunities. The key is to treat the market as multi-dimensional: equipment sales are only one revenue stream; services, tech, and facility partnerships will define the winners.

POM Pickleball Story

Our brand is called “POM”, and we are committed to providing high-quality sports equipment and accessories for pickleball enthusiasts. We believe that pickleball is not only a competitive sport, but also a lifestyle. It combines the characteristics of tennis, table tennis and badminton, and is suitable for people of all ages and skill levels. Whether it is a gathering with friends and family or a formal competition, pickleball can bring people closer together and enhance mutual understanding and friendship.

“POM” is full of love for the sport of pickleball and a sense of responsibility for the pickleball community. We have gathered a passionate and experienced team, and we have devoted our efforts to every link from product design to production and manufacturing. We not only focus on the quality and performance of the product, but also pay attention to making every user feel the fun of pickleball. Whether it is a beginner or an experienced player, our products can meet different needs, helping every sports enthusiast to break through themselves and enjoy the joy of the game.

Why Choose POM

HIGH END QUALITY:As one of the best pickleball seller, our QC team will ensure every single product you receive are best quality.

PRODUCT DESIGN: Our design department has complete process of making drawings into reality. We also improve your product design based on our years of working experience.

STABLE DELIVERY TIME:As one of the best pickleball manufacturer & supplier,we have sufficient manufacturing capacity, big orders won’t beat us, we can still deliver the order for you in time.

BEST PRICE: We have source factory of pickleball and accessories in China, that’s why we can provide high quality bags with best price.

PRECISE MANAGEMENT:Nothing can be achieved if we don’t implement precise management. We are a company with complete management system.

7-24 SERVICE:As the best pickleball manufacturer, 24-7 immediate response: We’ll receive your feedback to make us a better supplier. We’ll deal with any problems till you feel satisfied.contact us(+86 18902611680)

FAQs About POM

We are a Chinese top manufacturer and our factory is located in Dongguan. Welcome to visit our factory!

• We are a professional pickleball and accessories product provider. We can produce kinds of pickleballs for multi-purpose.

• We provide one-stop services and accept custom designs as your requirements.

• For those who love pickball, our products are for you, whether you are a professional pickball player, or a beginner, you will find the right product!

•Of course, usually we will provide samples for your testing. For custom printed samples, pls send your requirements to us for checking the sample cost.

• It takes about 7 days for sample production.

Yes, we provide free design services, structural design and simple graphic design with your logo.

Sure. We can do any packaging with your design. You can still have your own logo.

Bulk order depending on the order quantity and production details, it will take about 15 to 20 days.

Always a pre-production sample before mass production; Always final Inspection before shipment

• Size, material, printing details, quantity, shipping destination, etc.

• You can also just tell us your requirements and we will recommend products to you.

• By sea, by air or by express.

• If you have your own freight forwarder in China, it is the ex-factory or FOB price.

•CFR or CIF, etc., if you need us to ship on your behalf.

• DDP and DDU can also be used.

• More choices, we will consider your choices.

• The price is determined by the quantity, material, processing method, size and other factors. In addition, due to our continuous

technological innovation, the prices of some of our products are extremely competitive, please contact us to quote.